Refunding on Invoices

Best practices on refunding your Invoice

When you have a client who wants to return their purchase, it's important to refund the purchase on the invoice, whether Stripe is integrated or not. Since the platform is reactive to adjusting invoices (putting artwork back in inventory, recording invoicing data and adjustments), we want to share the best practices on refunding these purchases.

Refunding Artworks

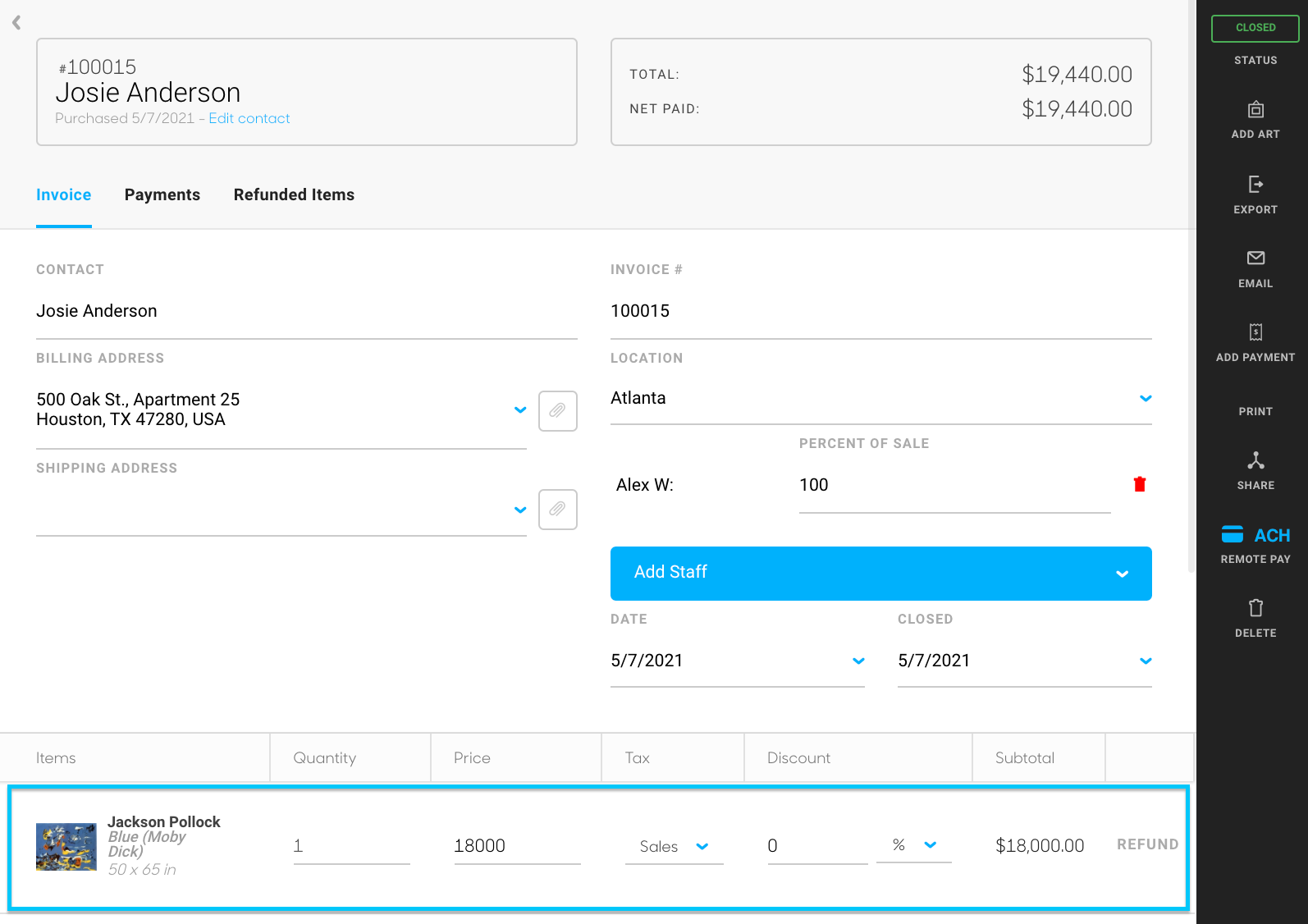

Whether the client is refunding one piece or multiple pieces, you'll want to refund your Invoice from the line items section of the Invoice tab. A REFUND button will appear when you hover to the right of the Subtotal of the line item.

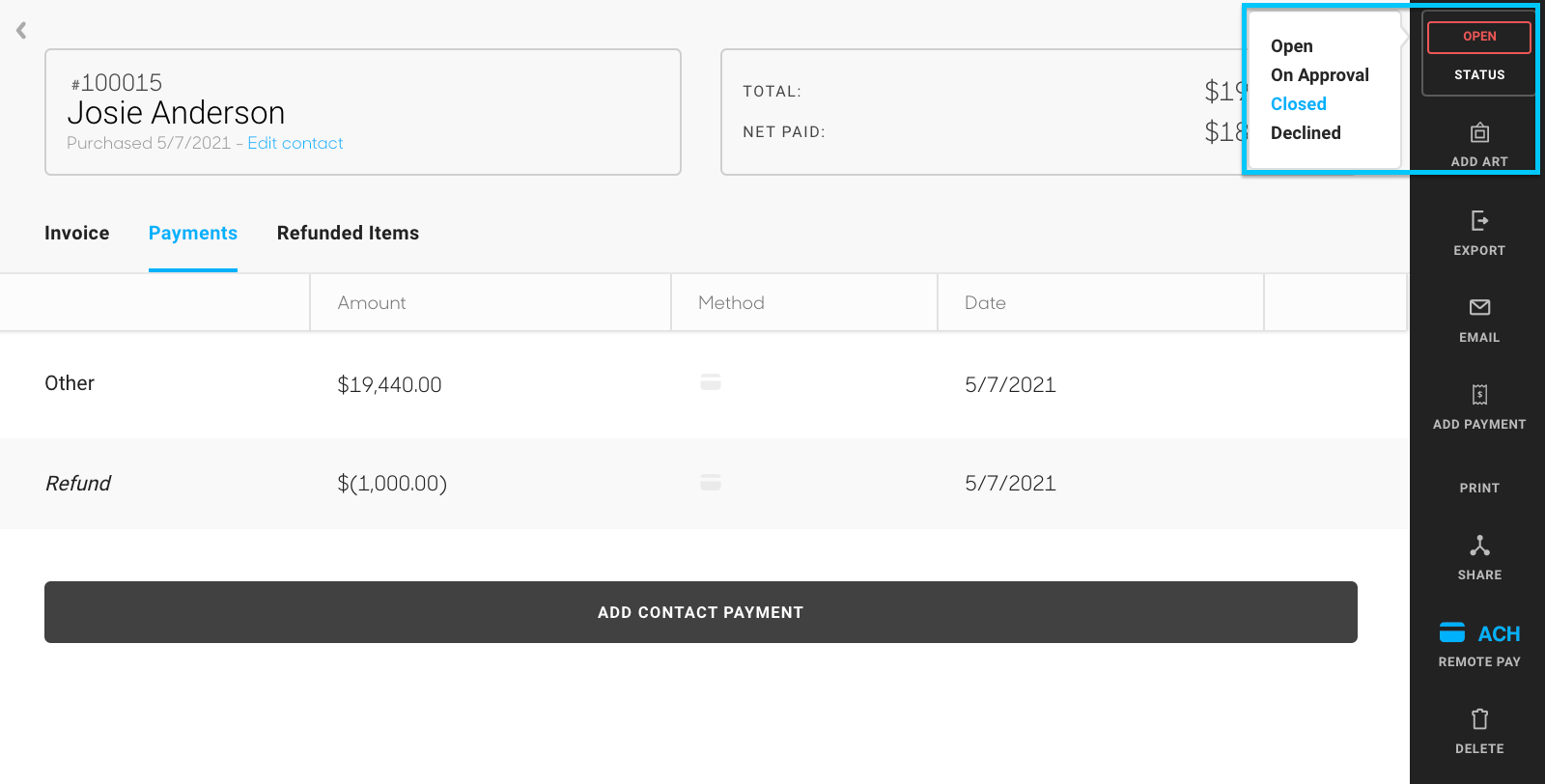

You can only refund an artwork once payment has been received in full and the invoice is CLOSED. Otherwise, you can remove an artwork from an Open invoice by clicking on the trash can next to the inventory piece on the Invoice.

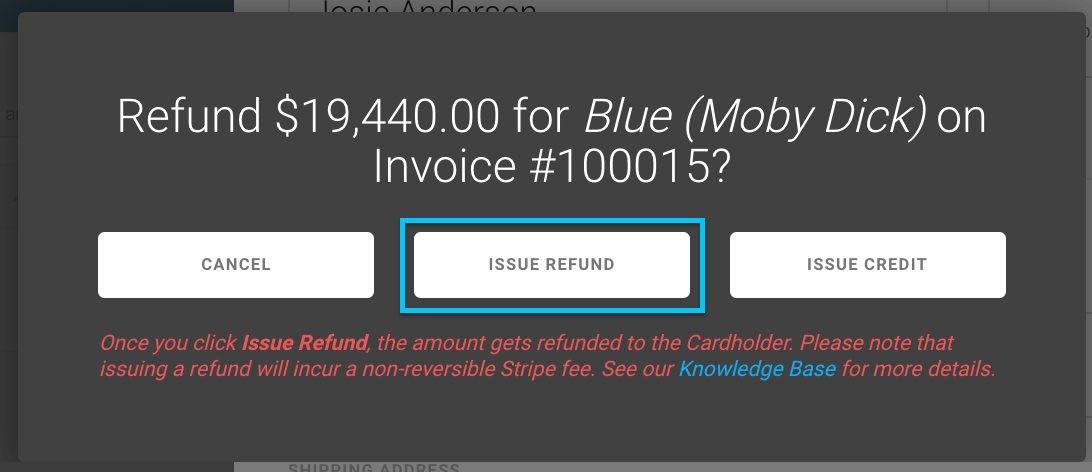

After you click on REFUND, a pop-up will appear. Once you click on "Issue Refund", the amount automatically gets returned to the Cardholder.

When you refund the line item, a few things happen: the item will go back into Inventory as active, the full amount of the item will be refunded to the Cardholder, and Stripe will charge a non-reversible fee.

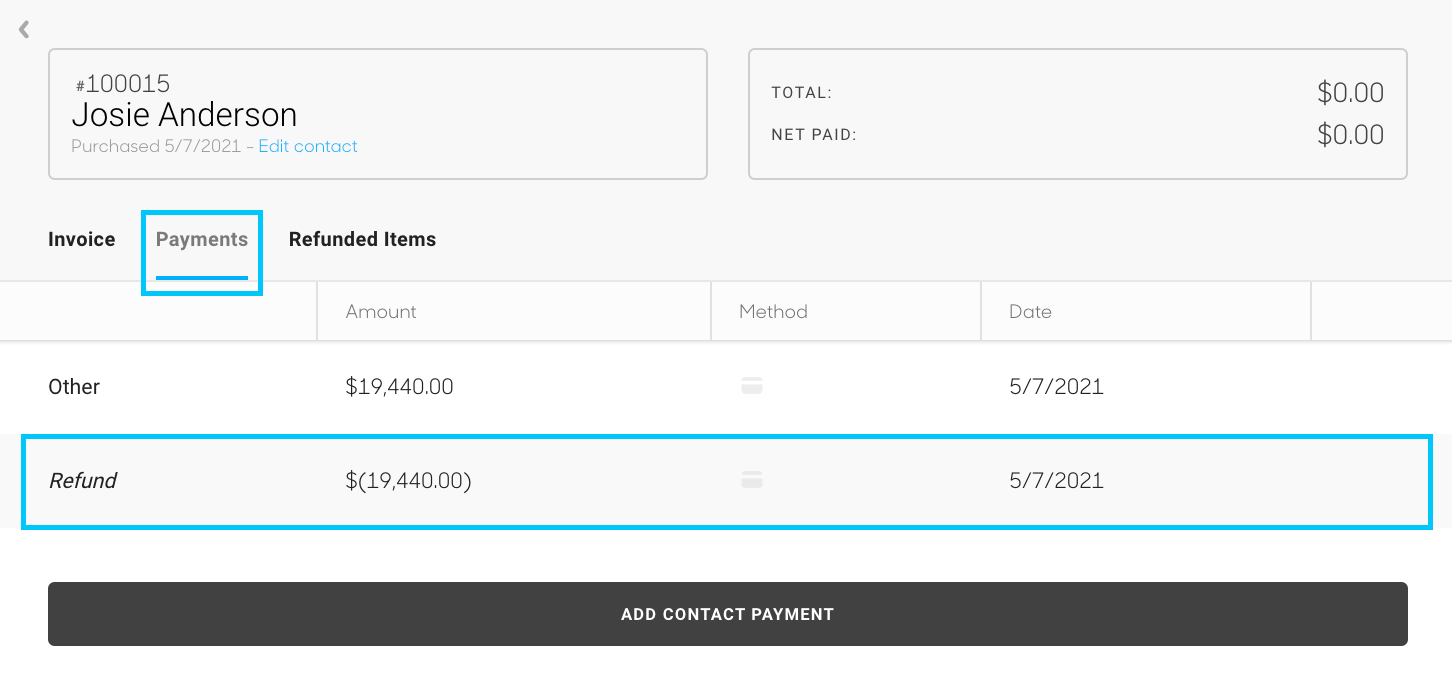

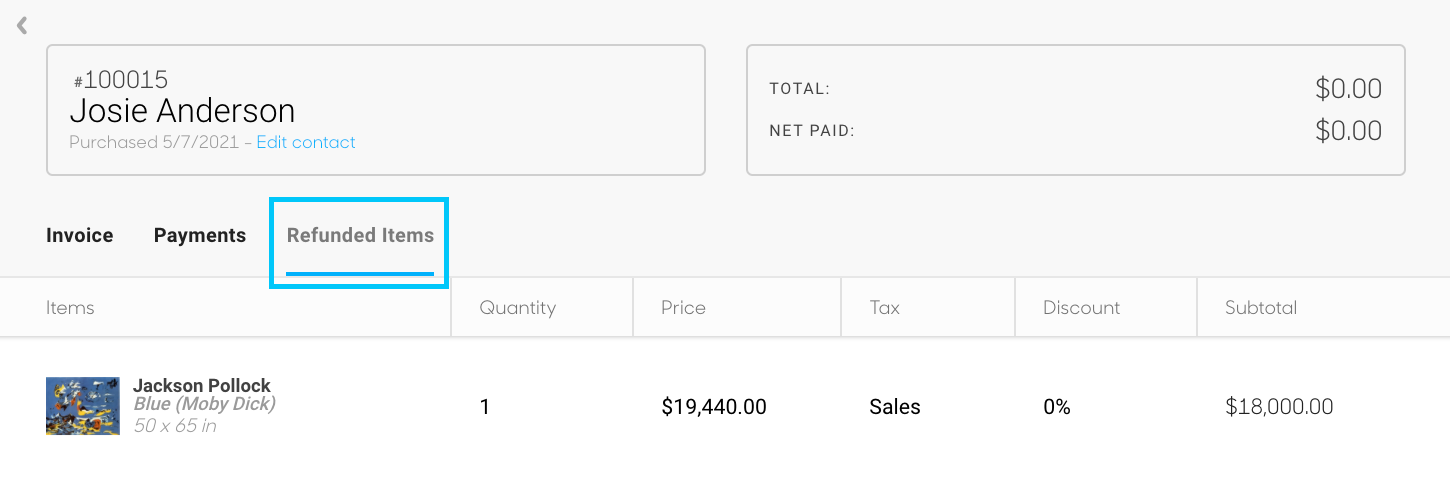

Once "Issue Refund" has been selected, you will see the total zero out, the refund reflected on the Payments screen, and the item listed under Refunded Items:

You can not issue a partial refund for an artwork line item. You can issue a partial refund from the overall payment on the Payments tab.

When issuing a refund after the payment was received through Stripe, Stripe will have to process the refund and you should see this properly reflected in your account 1-2 business days after issuing the refund of the item.

When issuing a refund after the payment was manually input (either the transaction was in-store, the transaction was paid with cash, or the transaction was done via credit card), you will need to initiate the monetary refund outside of ArtCloud, since the manually input transaction is solely recorded for bookkeeping within ArtCloud.

Issuing Partial Refunds

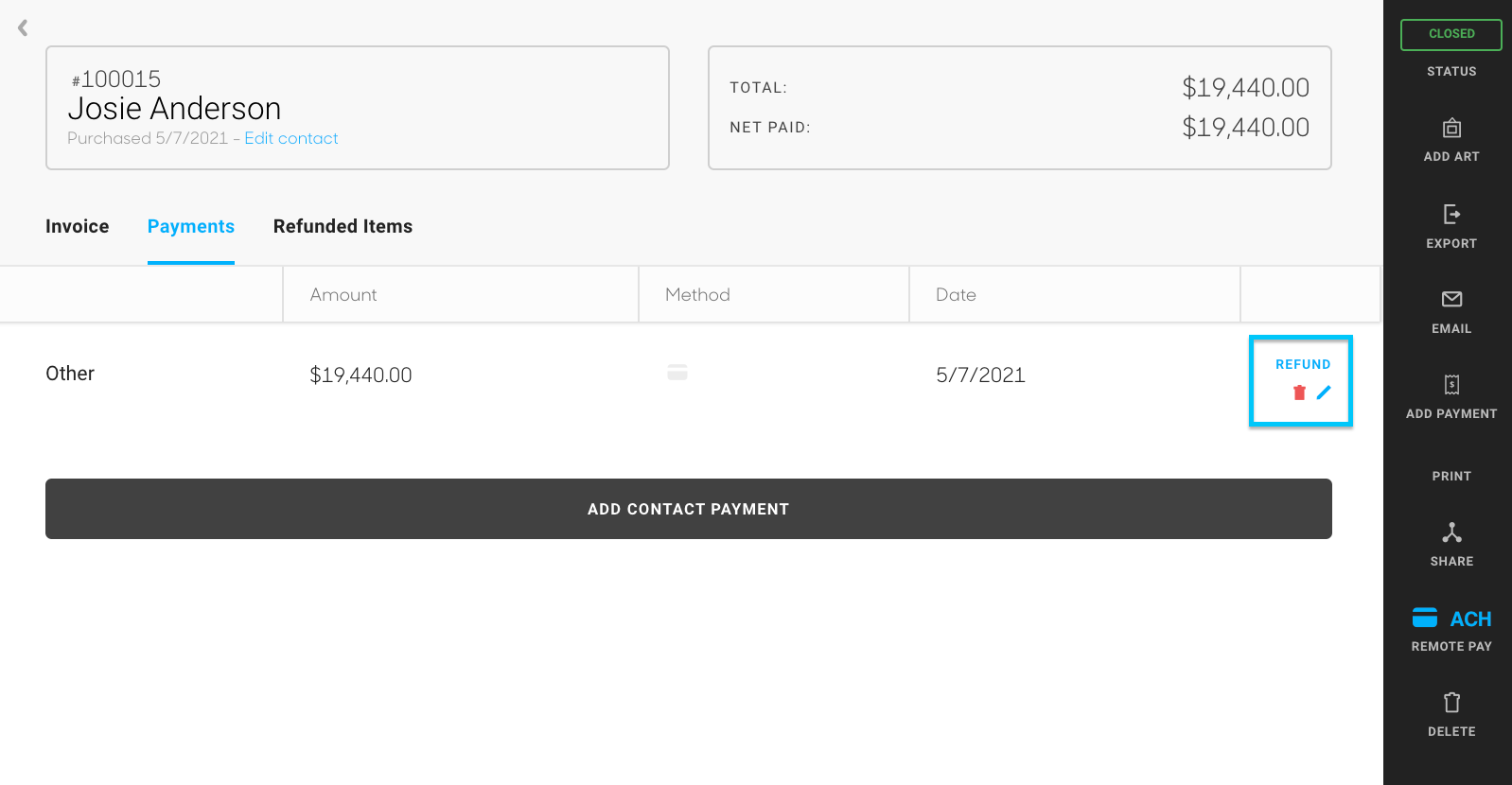

If you'd like to issue a partial refund from an invoice, we recommend refunding from the Payments tab of the invoice. Let's say you charged the wrong amount for sales tax, and you want to partially refund the client this amount.

You should navigate to the Payments tab of the invoice and hover over to the right side of the Payment amount until you see the blue REFUND option.

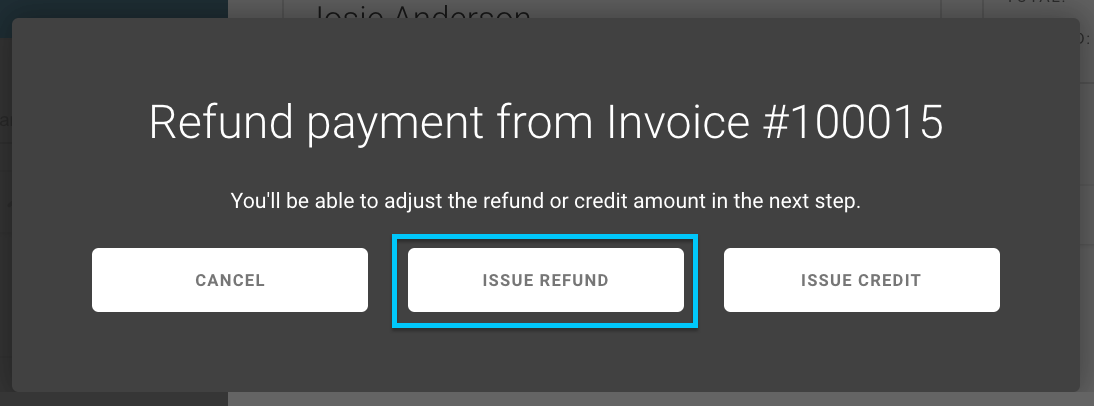

Once you click on this REFUND option, you'll want to proceed by clicking on Issue Refund.

You will be able to adjust the refund amount on the next screen.

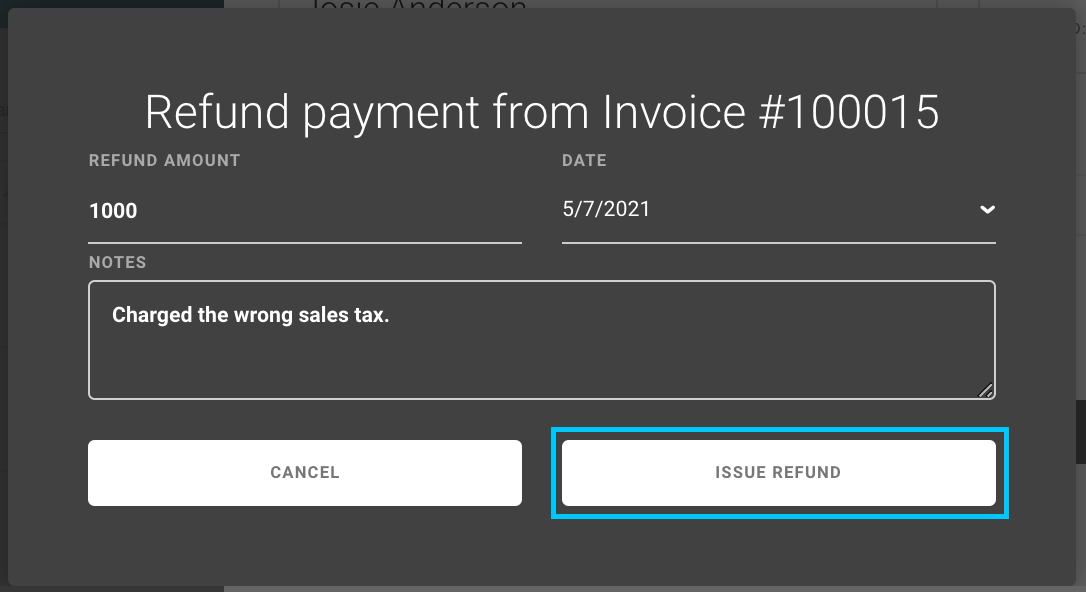

You'll be able to customize the amount of the refund on this pop-up in addition to adding any notes or adjusting the date of this partial refund. Once you've entered the details, you'll click "Issue Refund", and the partial refund will go back to the Cardholder.

Once you submit this partial refund, you'll see the Refund reflected on the Payments screen and, the Invoice will be Open. You can then Close the invoice.