Track incurred expenses for artwork

Use the artwork record to record any incurred expenses associated with a given piece of artwork.

The Incurred Expense feature of Artwork Financials is a powerful feature that allows galleries to track costs or value-added (and marked up) features to an artwork and accurately track what is due to the consigner.

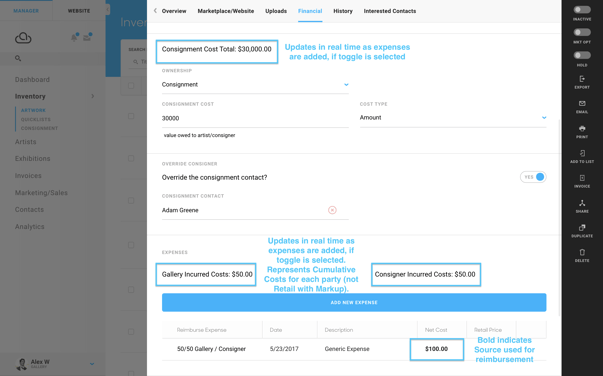

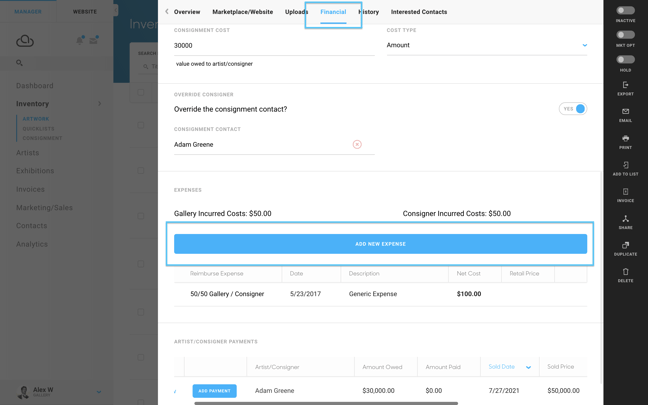

To record and report on incurred expenses associated with a given artwork, manage those from the Financials tab of the artwork record.

From the Financials tab on an Inventory Item, to record an expense, click on the blue Add New Expense button.

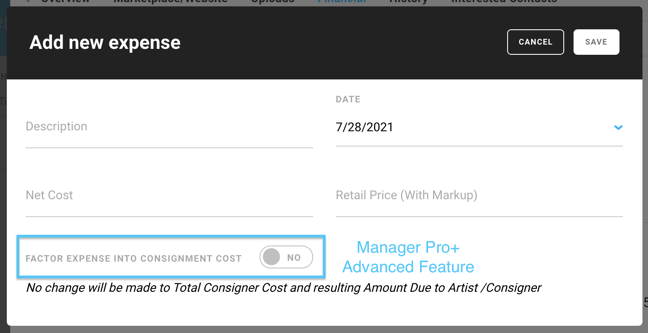

This will open a modal that allows you to enter details about the Incurred Expense. Here, you can add a Description of the expense, as well as documenting the Net Cost of the Expense, and Retail Price (with markup) if applicable.

NOTE: An example of retail markup might be that a gallery adds a frame that cost them $800, but they added a total of $1000 to the Artwork Price for the added frame. $1000 would be the Retail Price (With Markup) in this example.

If the "FACTOR EXPENSE INTO CONSIGNMENT COST" is left at the default "No" setting, the expense will be recorded on the financial tab for posterity, but no financial adjustments to amounts due to the Consigner are made.

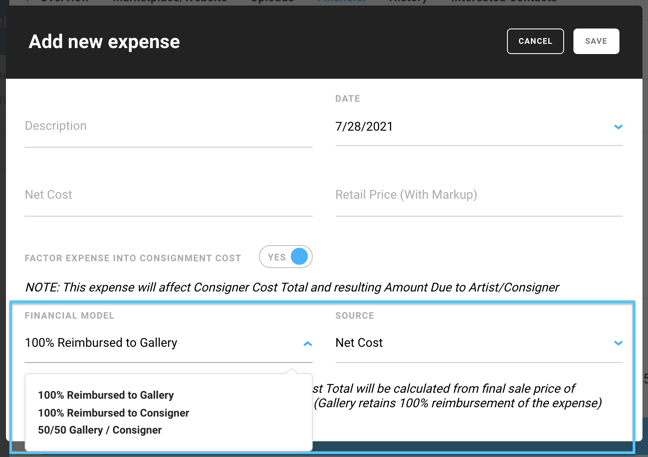

ArtCloud Manager Pro+ has additional features around Incurred Expenses for galleries that allow you to factor expenses into the amount owed to the Consigner (if the artwork is consigned as a percentage). If you are a Pro+ Customer, you can toggle the "Factor Expense Into Consignment Cost" on, which will reveal advanced financial options.

NOTE: If the ownership model for a work is a CONSIGNMENT PERCENTAGE, enabling this toggle will affect Consigner Cost Total and resulting amount due to Artist/Consigner when the inventory item sells. If the ownership model is CONSIGNMENT AMOUNT, the consignment amount remains fixed and no expenses will affect Consigner Cost Total.

Financial Model: The financial model indicates how this expense affects Consigner Cost with three options:

- 100% Reimbursed to Gallery. Gallery is fully reimbursed "off the top” : Consigner Cost Total will be calculated from final sale price of inventory item minus 100% of this expense’s amount (Gallery retains 100% reimbursement of the expense)

- 100% Reimbursed to Consigner. Consigner is fully reimbursed "off the top”, adding this amount to Consigner Cost Total . Amount due to Consigner will include [100% reimbursement on this expense] plus [consignment cost due for the final sales price of inventory item MINUS this expense]

- 50/50 Gallery / Consigner. 50% of this amount will be deducted from Consigner Cost Total [Consigner is sharing the cost with the Gallery]

- Reminder: if you want this expense to have no impact to Consigner Cost, simply turn the toggle for "FACTOR EXPENSE INTO CONSIGNMENT COST" off.

Source: This fields allows the user to designate which metric they would like reimburse:

- Net Cost -- the financial adjustments above will be applied using the Net Cost number entered in the modal.

- Retail Price. -- the financial adjustments above will be applied using the Retail Price number entered in the modal.

As you add expenses to an inventory item, they are added to the Incurred Expenses table below the blue button, and the reported amounts for Consignment Cost Total, Gallery Incurred Costs and Consigner Incurred Costs update accordingly.